On this page

What's next

Earn a high-yield savings rate with JG Wentworth Debt Relief

Despite stigma around the subject, debt is a common part of everyday life in America today. In fact, U.S. consumer debt has reached a record $18.388 trillion. [1] In addition to unexpected costs, many people take on debts during important milestones in their lives: getting their first car, going to college, or purchasing their first home with a mortgage.

Because of this, the types of debts we take on – and when we take them on – change across our lifetime. To find out how much the average American accumulates in debt over their lifetime, we analyzed four common different debt types and average interest amounts (mortgages, student loans, auto finance, and credit card debt), and how much someone could be expected to owe per year of their life. The study also considered how the average debt in each category varied per state.

Key Findings:

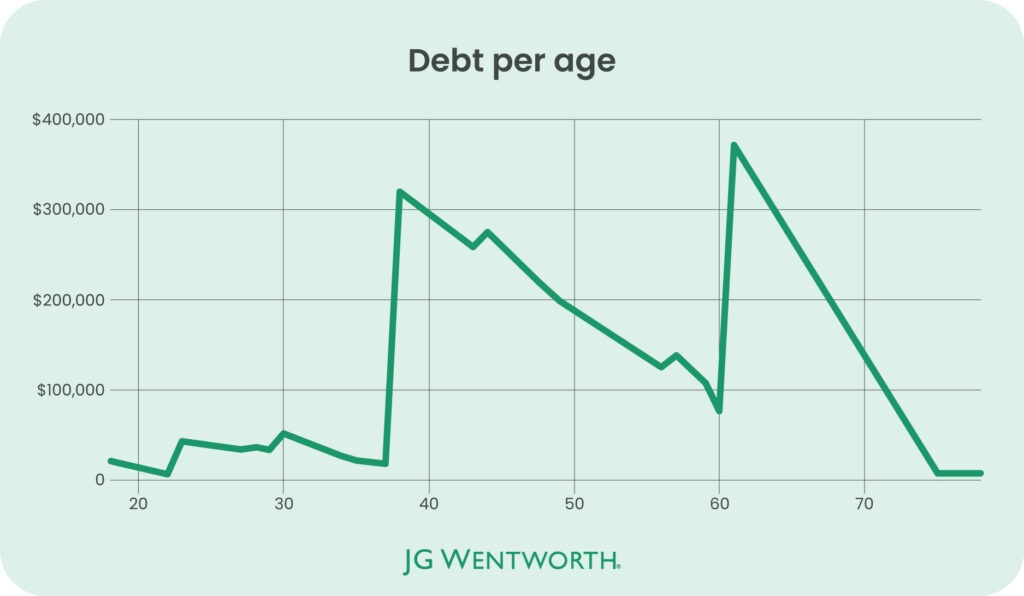

- Debt peaks at age 61, the typical age of a second-time homebuyer, with a total debt amount of $370,259.

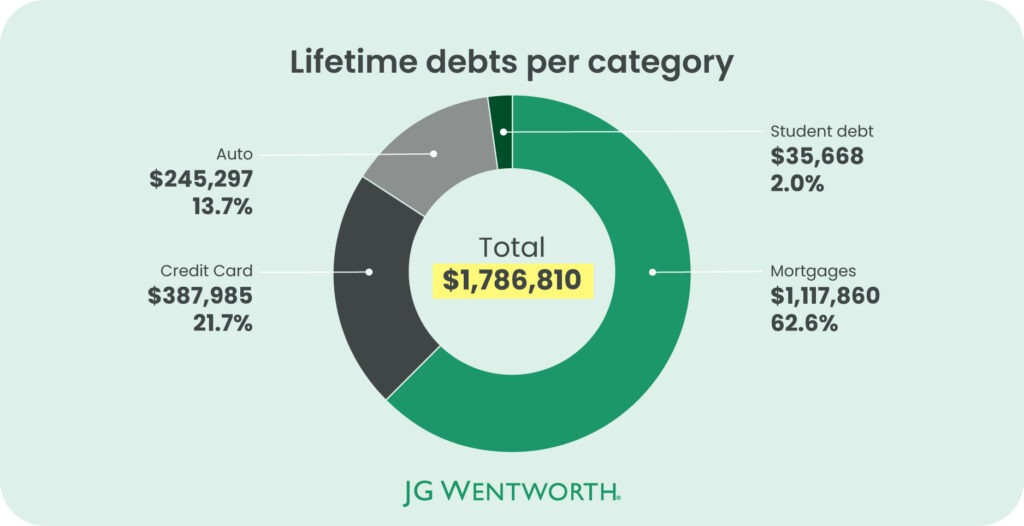

- On average, the total amount of debt an American can expect to pay off in their lifetime is $1,786,810.

- Lifetime residents of Hawaii can expect to pay off debts worth $2,570,976 in their lifetime – more than any other state.

- Lifetime residents of West Virginia can expect to pay off debts worth $1,391,240 in their lifetime – less than any other state.

How does debt fluctuate as you age?

Considering the typical milestones in life – such as buying your first car, attending college, and purchasing your first home – alongside other standard occurrences, like accruing credit card debt, the average amount you can expect to be in debt fluctuates across a lifetime.

Between the time an American turns 18 and the average mortality rate, which is 78 in the U.S., [2] they can expect to have accrued an average of $1,786,810 in debt across their lifetime. But at which ages can Americans expect to be most and least debt-burdened?

By the age of 18, a young adult can both become a full-licensed driver and take out a credit card. Considering the average debts for both auto finance on a first car and credit cards the total amount of debt at the startpoint is $20,718.

Once a young adult begins working though (at age 20), this amount declines until an up-tick from $5,764 at 22 to $42,242 at 23, when most students will graduate from college and start paying back their loans. Likewise, debt increases to $51,287 at age 30, when most people will buy their second car. [3]

Eight years later, at age 38, the amount of debt accumulated soars to $320,092 as the average age an American now purchases their first home. [4]

This investment catapults the total debt figure from $17,139 at age 37 to $320,092 at age 38 – by far the greatest increase in the study. Following this, though, debt trends downwards as repayments are made (although there are slight upticks caused by auto finance with the purchase of the 3rd and 4th vehicles).

At 61, the average American buys their second home, [4] and this investment skyrockets the total amount of debt to $370,259. For the purpose of the study, at this age the average loan term was calculated to be 15 years, as opposed to 30 years for first time buyers at 38.

By the time an American retires (at the average age of 67), debt has decreased to $212,596.

Between 75 and 78, Americans are expected to incur $6,754 worth of credit card debt every year, and this remains their only debt for those few years. [10]

Which states have the greatest lifetime debts?

Considering the average from all U.S. states, the total amount of debt an American can expect to pay off in their lifetime is $1,786,810. But this figure varied by as much as $1,179,736 between the most and least expensive states in the study.

Hawaii has the highest average individual lifetime debt, coming to $2,570,976. Almost three quarters (71.1%) comes from mortgage debt and almost a fifth (17.6%) comes from credit card debt.

Following Hawaii is California, where the average lifetime debt totals $2,558,698, and Washington, with $2,319,385.

West Virginia is the state with the lowest average individual lifetime debt, amounting to $1,391,240. West Virginia has the lowest mortgage costs ($784,006), the 4th lowest credit card debt ($325,620), and 6th lowest student loan debt ($32,358). Following West Virginia is Iowa, with a total of $1,431,251, and Kentucky, with a total of $1,448,664.

The average lifetime debts per category and state

| State | Auto Debt (4x cars + interest) | Credit Card | Mortgage (2x homes + interest) | Student Loan (loan + interest) | Total |

|---|---|---|---|---|---|

| Hawaii | $250,154 | $453,600 | $1,829,064 | $38,158 | $2,570,976 |

| California | $251,661 | $424,800 | $1,844,069 | $38,168 | $2,558,698 |

| Washington | $228,887 | $418,500 | $1,635,236 | $36,762 | $2,319,385 |

| Massachusetts | $216,589 | $411,180 | $1,572,519 | $35,529 | $2,235,817 |

| Colorado | $263,636 | $436,020 | $1,449,998 | $37,392 | $2,187,046 |

| New Jersey | $222,055 | $456,300 | $1,448,779 | $37,201 | $2,164,335 |

| Utah | $254,697 | $391,920 | $1,384,555 | $33,746 | $2,064,918 |

| Nevada | $266,692 | $438,480 | $1,297,147 | $34,589 | $2,036,909 |

| Maryland | $242,476 | $449,520 | $1,285,208 | $43,692 | $2,020,895 |

| Alaska | $290,056 | $484,620 | $1,189,941 | $35,821 | $2,000,438 |

| New York | $213,962 | $420,600 | $1,327,161 | $38,690 | $2,000,414 |

| Virginia | $230,298 | $432,000 | $1,273,394 | $40,137 | $1,975,829 |

| Connecticut | $234,195 | $454,080 | $1,240,567 | $36,672 | $1,965,514 |

| Rhode Island | $217,805 | $401,160 | $1,283,317 | $33,270 | $1,935,552 |

| Arizona | $253,467 | $408,000 | $1,217,359 | $35,675 | $1,914,500 |

| Oregon | $228,065 | $371,940 | $1,270,497 | $37,829 | $1,908,331 |

| Florida | $250,017 | $443,520 | $1,142,160 | $39,262 | $1,874,959 |

| Texas | $255,170 | $448,020 | $1,137,567 | $33,581 | $1,874,338 |

| Georgia | $280,453 | $434,280 | $1,114,052 | $42,026 | $1,870,812 |

| Montana | $266,276 | $367,320 | $1,180,432 | $33,945 | $1,847,974 |

| New Hampshire | $200,908 | $401,520 | $1,210,433 | $34,884 | $1,847,746 |

| Idaho | $226,505 | $367,860 | $1,171,407 | $33,281 | $1,799,054 |

| North Carolina | $266,888 | $386,040 | $1,098,782 | $38,695 | $1,790,405 |

| Illinois | $248,922 | $403,560 | $1,088,666 | $39,055 | $1,780,203 |

| Delaware | $227,553 | $410,460 | $1,060,685 | $38,683 | $1,737,381 |

| Tennessee | $269,879 | $374,580 | $1,047,360 | $36,886 | $1,728,705 |

| New Mexico | $274,633 | $361,380 | $1,052,678 | $34,280 | $1,722,971 |

| Wyoming | $279,519 | $384,360 | $1,011,840 | $31,503 | $1,707,221 |

| South Carolina | $269,117 | $389,880 | $981,658 | $38,770 | $1,679,425 |

| Maine | $213,058 | $349,560 | $1,069,005 | $34,292 | $1,665,914 |

| Minnesota | $218,419 | $364,080 | $1,040,590 | $34,071 | $1,657,160 |

| Pennsylvania | $225,729 | $374,700 | $1,018,045 | $36,267 | $1,654,741 |

| Vermont | $202,371 | $355,680 | $1,055,931 | $38,404 | $1,652,387 |

| North Dakota | $254,999 | $359,460 | $951,622 | $29,647 | $1,595,728 |

| Louisiana | $281,865 | $381,540 | $892,236 | $34,866 | $1,590,507 |

| South Dakota | $253,012 | $343,020 | $942,232 | $30,928 | $1,569,192 |

| Alabama | $275,399 | $364,440 | $890,676 | $37,709 | $1,568,223 |

| Kansas | $248,747 | $364,920 | $878,886 | $33,119 | $1,525,672 |

| Missouri | $240,543 | $362,520 | $884,370 | $35,675 | $1,523,108 |

| Oklahoma | $265,741 | $377,460 | $844,302 | $32,103 | $1,519,606 |

| Arkansas | $269,593 | $349,560 | $862,669 | $33,858 | $1,515,680 |

| Nebraska | $226,416 | $356,700 | $891,393 | $32,377 | $1,506,886 |

| Wisconsin | $217,177 | $322,200 | $933,856 | $32,628 | $1,505,862 |

| Michigan | $213,769 | $355,920 | $876,785 | $36,974 | $1,483,448 |

| Ohio | $215,454 | $352,260 | $876,294 | $35,033 | $1,479,041 |

| Mississippi | $274,787 | $333,180 | $827,016 | $37,254 | $1,472,236 |

| Indiana | $235,817 | $337,260 | $856,862 | $33,243 | $1,463,183 |

| Kentucky | $249,925 | $323,940 | $841,329 | $33,470 | $1,448,664 |

| Iowa | $252,221 | $319,740 | $828,365 | $30,925 | $1,431,251 |

| West Virginia | $249,256 | $325,620 | $784,006 | $32,358 | $1,391,240 |

Lifetime debts per type

Some debt types are much greater than others. Mortgage debts, for example, total an average of $1,117,860 (62.6% of the total lifetime debt), whereas student loan debts total an average of $35,668. The study breaks down the lifetime debts of four main debt types (auto loans, student loans, mortgages, and credit card debt) including interest (excluding interest on credit card debt), and in which states you can expect to pay much more – and much less – than the average.

Auto loans

The most recent data, from 2024, shows that most new vehicles purchased in the U.S. were bought partially or completely via financing. [5] Car financing is one of the most common forms of personal debt, and the average American purchases four cars over their lifetime. [6] Considering the average used car price per state and deducting a 20% down payment, the study found that the average lifetime auto debt equates to $245,297. [7]

But due to higher used car prices, some states had considerably greater lifetime auto debt totals. These were Alaska ($290,056), Louisiana ($281,865) and Georgia ($280,453). Three states with much cheaper used car prices – and therefore smaller totals of lifetime auto debt – are New Hampshire ($200,908), Vermont ($202,371), and Maine ($213,058).

Mortgages

The average American purchases two homes across their lifetime, using data available from the National Association of Realtors, the study considered the typical ages a homeowner purchases their first and second homes. [4] To calculate the lifetime total of mortgage debt, the study calculated the separate totals of an average mortgage for a first-time buyer and a second-time buyer. The study estimates that an average American will accumulate a mortgage debt of over $1,117,860 over their lifetime. [8]

But this varies regionally by as much as $1,060,062 between the most and least expensive states. If you spend your lifetime in California, a two-time homebuyer can expect their total lifetime mortgage costs to be around $1,844,069. Hawaii is close behind, with a total mortgage sum of $1,829,064. Residents of Washington state can expect to accrue the third-most, with $1,635,236.

On the other end of the spectrum, a two-time homebuyer in West Virginia can expect their total mortgage costs to come to a much lower figure of $784,006. In Iowa, the lifetime mortgage debt came to $828,365, and in Mississippi $827,016.

Credit card

According to data by CivicScience, around half (56%) of credit card users report they have some kind of revolving credit card debt, while the other half (45%) pay off their balances monthly. [9]

The study revealed that individuals aged 18 to 27 carry an average of $3,456 in credit card debt each year. This amount peaks at 44 to 59 ($9,557 a year) and drops at 60 ($6,754 yearly). Taking an average across all states analyzed, this would rack up to $387,985 over a lifetime. [10]

Considering how credit card debt can quickly accumulate, it’s perhaps unsurprising that our recent research found that it is one of the most stressful debt types.

Comparing the average person’s credit card debt in each state, Alaskans can expect their credit card debt to total around $484,620 in their lifetime – more than anywhere else. New Jersey follows, with $456,300, and Connecticut is third with $454,080.

Credit card debt appears to cause the fewest issues in Iowa, where the lifetime total averaged at $319,740. Wisconsin had a similarly low estimate of $322,200, followed by Kentucky with $323,940.

Student loan debt

Our recent survey found that on average, most people overestimated the total student loan debt of a new graduate by $17,969. Considering that 82.9% of postsecondary students are undergraduates, the majority of the American population will accrue some kind of student loan debt, and federal loan debt represents 92.2% of this. [11]

Taking an average total student loan debt from all the states, the average amount is $35,668. Maryland appears as one of the more expensive states for debt. Considering student loan debt, the average amounts to $43,692 – $8,024 more than the study average. Next up is Georgia with $42,026, and then Virginia with $40,137.

North Dakota has the most affordable federal student loan costs, with the total for an undergraduate degree coming to $29,647. Iowa is not far off this amount with $30,925, and South Dakota follows with just $3 more, at $30,928.

Methodology

To uncover how much debt an American accumulates over their lifetime, the study first considered the average lifespan of an American adult: from age 18 to 78, which is the current U.S. mortality rate.

Secondly, the study analyzed four debt types including average interest amounts: auto loans, student loans, mortgages, and credit card debt. The study did not include an interest amount for credit card debt because of the wide variability in rates. These debt types were chosen because a majority of the population has these debt types. Other debt types – such as medical debts and personal debts – were discounted because only a small percentage of the population has these types of debt.

The average U.S. mortgage per state was taken from an Experian study, and the average term from Bankrate. To calculate the fixed monthly payment needed to fully repay a loan (both principal and interest) over a set period of time, the study used an amortized loan payment formula.

The average credit scores per state and loan amount for first-time mortgages and repeat buyers mortgages were taken from LendingTree.

The likelihood that Americans purchased new or old cars at different ages was taken from YouGov. The recommended age to stop driving was taken from the AAA Exchange. The loan term for auto finance was taken from Experian, and an amortized loan payment formula was used to calculate repayment amounts. The average price of a used car per state was taken from iSeeCars, and the average down payment per state was from KBB.

The average student debt for federal student loans was taken from education data, alongside how long it typically takes to pay off, and the varying costs per state. The study calculated the debt of undergraduate students because college enrollment data shows that 82.9% of postsecondary students are undergraduates.

The average credit card debt per state was taken from Experian, alongside the timeline for this type of debt to be paid off.

All data was collected and analyzed between June and August 2025, and is correct as of August 2025.

Sources

[1] Federal Reserve Bank of New York, ‘Household Debt and Credit Report”, 2025

[2] U.S. Centres for Disease and Control, ‘Life Expectancy – FastStats’, 2023

[3] Reuters, ‘US consumers keep vehicles for a record 12.5 years on average -S&P’, 2023

[4] National Association of Realtors, ‘First-Time Home Buyers Shrink to Historic Low of 24% as Buyer Age Hits Record High‘, 2024

[5] YouGov, ‘Pre-owned or brand new? America’s car buying preferences’, 2025

[6] Experian, ‘What’s the Average Length of a Car Loan?’, 2024

[7] Kelley Blue Book, ‘How Much Is the Typical Car Down Payment?’

[8] LendingTree, ‘3 in 5 Mortgage Offers on LendingTree Platform Go to First-Time Buyers’, 2025

[9] Civic Science, ‘More Than 40% of American Households Rely on Credit Cards to Pay the Bills, Leading to a Vicious Debt Cycle’, 2024

[10] Experian, ‘Average Credit Card Debt Increases 3.5% to $6,730 in 2024’, 2024

[11] Education Data Initiative, ‘College Enrollment Statistics [2024]: Total + by Demographic’, 2024

About us

With over 30 years’ worth of experience, JG Wentworth is an American financial services company that specializes in structured settlements, annuity purchases, debt relief solutions, and other offerings. JG Wentworth has helped resolve over 2.9 billion debts and 4 billion structured payouts.