On this page

What's next

Earn a high-yield savings rate with JG Wentworth Debt Relief

Debt Numb: The correlation between increasing debt and levels of stress

by

JG Wentworth

•

September 17, 2025

•

12 min

A popular 2010 study reported that happiness peaks at an income of $75,000, and that any increase above this doesn’t necessarily guarantee an increase in well-being. [1] A 2023 study pushed the goalpost considerably further, estimating that well-being increases up to an annual salary of $500,000. [2]

But at what point might someone become psychologically detached and resigned to their debt? To find out if Americans do experience “debt numbness” (and at which point it is reached), a survey of 1,186 people was conducted, comparing stress levels with amounts of debt. Using this data, the study could then examine where stress levels plateaued or even declined, and which types of debts are most and least stressful.

Key Findings:

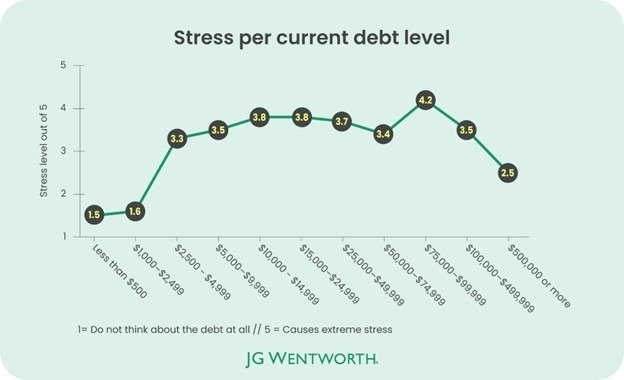

- Americans become “debt numb” when debts total $75,000 to $99,000, with stress levels peaking at an average of 4.2 out of 5.

- Respondents were more stressed by debts totaling $2,500 – $4,999 (3.3 out of 5) than they were by debts totaling more than $500,000 (2.5 out of 5).

- Credit card debt is the most stressful form of debt (4 out of 5).

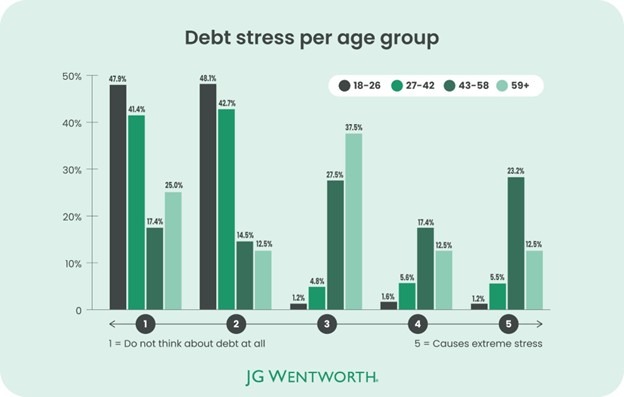

- Nearly half, (48.1%) of 18-26 year-olds have a stress level of 2 regarding their current debts – the age group least worried about their debts.

- 47% of Americans worry about their debt every day.

- Half (50%) admit to actively avoiding looking at their bank statements.

- More than half (54.6%) of respondents feel ashamed or embarrassed about their debt.

When do people become numb to debt?

If you’re in debt, you’re not alone. In fact 98% of the 1,186 people surveyed said they were currently in some form of debt.

But how stressed are people about their debt? The study asked respondents to rate their stress levels on a scale of 1 to 5, with 1 being “I don’t think about it at all” and 5 being “It causes me extreme stress”.

The degrees of stress respondents felt about their current debt varied by the amount. Those with minimal debts of less than $500 reported the lowest stress levels of 1.5/ 5, and stress increased as the volume of debt increased, reaching a peak at 4.2/5 when a respondent’s debts totaled $75,000–$99,999.

However, respondents did appear to become “debt numb” at this point. After this, stress levels actually decreased for individuals with greater debt burdens, dropping to 3.5 for those with $100,000 to $499,999 in debt and declining to 2.5 for those carrying $500,000 or more.

How stressed would people be if their total debt levels increased?

While this represents how stressed Americans are currently with their debts, what if the situation were to worsen? Our recent survey found that many Americans expected tariffs to cause a $2,000 cost-of-living increase in 2026. If the cost-of-living increases, this puts more financial pressure on paying off debts.

Why do people worry about their debt?

For many of those in debt, this financial burden is a frequent source of stress. Just under half of respondents (46.5%) worry about their debt every day, and half (49.6%) also avoid looking at their bank statements, potentially aggravating the situation further.

The greatest negative impact of debt was psychological, with more than half (54.6%) of respondents feeling ashamed or embarrassed about their debt, an indicator of the persistent social stigma surrounding debt, despite how common it is.

Half of the respondents (53.7%) also felt concerned about falling behind on monthly repayments, and therefore digging themselves into further debt. The same amount (53.7%) worried about their current debts, leaving them little to live on in old age, showing how easily this concern might become a reality. According to a study by the KFF, about one in ten seniors (aged 65 and older) lived in poverty. [3]

|

Most common debt concerns |

|

|

Concerns* |

Percentage of respondents |

|

Feeling ashamed/embarrassed about it |

54.6% |

|

Falling behind on the monthly repayments |

53.7% |

|

Having little to live on in old age |

53.7% |

|

Finding out they are more in debt/owe more money than originally thought |

53.5% |

|

Worry about losing home/having belongings repossessed |

53.3% |

|

Having little to leave to their children |

51.8% |

|

Being unable to support and take care of loved ones financially |

8.4% |

|

Don’t worry about debt |

3.8% |

*Respondents could select multiple answers.

Despite the social stigma still looming large, on an intellectual level, it seems that half of the respondents (53.4%) felt calmed by the fact that being in some form of debt is normal.

The second most common reason why respondents weren’t too anxious was that they felt that their debt levels weren’t high enough to cause concern (50.5%). Optimistically, half of those surveyed (50.2%) believe that they will make enough money in the future to pay off their debts.

|

Reasons why respondents weren’t worried about debt |

|

|

Reasons* |

Percentage of respondents |

|

It’s normal in today’s society to have debt |

53.4% |

|

I consider the debt I have to be a small amount |

50.5% |

|

I expect to make enough income in the future to pay it off |

50.2% |

|

I have enough income to cover the monthly repayments |

49.1% |

|

I can seek financial support from my family if necessary |

48.4% |

*Respondents could select multiple answers.

Responses to debt per age group

The older the respondent, the more likely they were to be stressed by their debts. The youngest respondents (aged between 18-26) were most likely to report the lowest level of stress about their current debts (47.9% having a stress level of 1, and 48.1% having a stress level of 2). Those aged between 27 and 42 were similar, with 84.1% of this age group feeling a stress level of between 1 and 2.

However, moving up an age bracket, those aged 43 and above were most likely to report a stress level of 3 (32.5%). One in five (23.2%) respondents aged between 43-59 also reported a stress level of 5 out of 5 (compared to just 1.2% of 18-26 year-olds).

Which debt types cause the most stress?

Would people be more stressed by debts piling up on their credit cards, or by a sudden increase in their medical debts? When considering how different types of debt affect stress levels, some debt types cause stress to rise quicker than others, and stress levels to plateau sooner than the rest. When considering the smallest increase ($500), buy now, pay later had the greatest starting stress level (at 3.0), and auto finance loans and mortgages had the smallest starting stress level (2.3). Four of the seven debt types showed a plateau in stress levels: credit card, medical, mortgage, and personal debts. Medical debt was the debt type that plateaued soonest at 3.1 out of five when debts increased by $20,000.| Increase ($) | Credit cards | Student loan | Medical | Auto | Mortgage | Personal | Buy Now, Pay Later |

|---|---|---|---|---|---|---|---|

| $500 | 2.7 | 2.4 | 2.8 | 2.3 | 2.3 | 2.9 | 3.0 |

| $1,000 | 3.1 | 2.7 | 2.8 | 2.6 | 2.3 | 3.1 | 3.2 |

| $5,000 | 3.6 | 3.0 | 2.9 | 3.1 | 2.9 | 3.4 | 3.7 |

| $10,000 | 3.8 | 3.2 | 2.9 | 3.3 | 3.3 | 3.6 | 3.8 |

| $20,000 | 3.9 | 3.3 | 3.1 | 3.6 | 3.5 | 3.7 | 3.8 |

| $30,000 | 4.0 | 3.4 | 3.1 | 3.8 | 3.5 | 3.9 | N/A |

| $40,000 | 3.9 | 3.5 | 3 | 3.9 | 3.6 | 3.9 | N/A |

| $50,000 | 3.9 | 3.5 | 2.8 | 4.0 | 3.6 | 3.9 | N/A |

Credit card debt

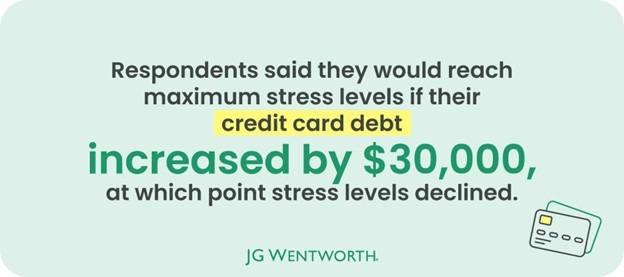

According to the Federal Reserve, 82% of Americans have at least one credit card, and at the end of 2024, credit card debt reached $1.21 trillion.[4] [5] Unlike other debt types (like auto loans or mortgages), credit card debt is unsecured, which means that there is nothing that the creditor can take as collateral if you fail to pay the debt. Credit card debts also typically carry higher APRs (the annual interest rate), meaning this type of debt can quickly accumulate. [6] When considering credit card debt by an increase in fixed dollar amounts, the data shows that stress intensifies until reaching a maximum at 4 out of 5 when the debts have increased by $30,000, at which point the stress levels decline.

Student loan debt

A report released by the Library of Congress estimates that nearly 43 million individuals (one in six adults) have federal student loan debt, which totals more than $1.6 trillion in 2025. [7] Although taking on student loans is a large obligation, it can also be considered a good financial investment if further education increases future earning potential.

When considering fixed dollar increases, the data suggest a near-linear relationship between the debt growth and increased stress. Starting at a stress level of 2.4 with a $500 increase, stress levels gradually increase until they reach an addition of $40,000, when stress levels remain around 3.5 thereafter. For context, the average student loan in the U.S. is $38,375, so an additional $40,000 would take this total to $78,375. [8]

Medical debt

Unlike other debt types in this study, which may reflect more considered financial decisions, medical debt can be more unpredictable and less avoidable. According to more research by the KFF, approximately 6% of adults in the U.S. owe over $1,000 in medical debts – including three million who owe more than $10,000. [9

When examining stress levels per additional dollar amount, the stress response appears more erratic than other debt types. Although stress does reach its peak level of 3.3 at an additional $25,000, there is no clear trend present in the responses.

Auto loan debt

Most new vehicles bought in 2024 were paid for partially or completely via financing. [10] Unlike mortgages, where the value of the asset typically appreciates, the value of a vehicle typically depreciates over time, meaning that auto loans create a situation where borrowers owe more than their vehicle is worth. [11]

Due to increasing vehicle prices, auto debt has grown substantially in the U.S. in recent years, with typical car loans now extending over 72 months. [12] But how stressed out would respondents be if their existing auto loans increased?

When looking at how stress about auto debt fluctuates via absolute dollar increases, the results show a different story. The data shows a consistent upward progression that continues through very high dollar amounts, singling out auto debt in comparison to other forms of debt, which showed more variable patterns. The stress levels begin at a score of 2.3/5 with a $500 increase, and escalate to 4/5 once the additional debt reaches $40,000.

Mortgage loan debt

Mortgage debt is frequently the largest and most significant financial obligation for Americans. [13] Unlike other debts in the study – particularly auto debts – mortgage debt is secured by an asset (real estate) that typically appreciates over time.

Although hitting a high level of stress (4 out of 5), unlike other debt types, respondents were less likely to reach a state of “debt numbness” when values increased by increments up to $100,000. This is perhaps because – although $100,000 is a significant amount of debt – mortgage debts are often already in the hundreds of thousands (the median house price in the U.S. is $410,800), so this reflects a smaller percentage increase than in other debt types. [14]

Personal loan debt

Personal debt covers a broad spectrum of borrowing types, and a loan might be taken out for a variety of reasons, such as making home improvements, covering emergency expenses, or to consolidate debt. Similar to credit card debt, interest rates are typically greater than other forms of debt because they are typically not backed up by collateral (e.g., a physical asset).

Looking at price increases, debt levels steadily increased – starting at 2.6 with a $100 increase – passing a stress level of 3 at an increase of $1,000, and reaching 4 (the greatest stress score for this debt type) when the amount had reached an additional $75,000, and declining slightly to a stress score of 3.9 at the maximum addition of $100,000.

Buy Now, Pay Later debt

Buy Now, Pay Later schemes, or BNPL for short, are loans where consumers can make purchases and pay for them over time, usually with no interest. These types of loans have become increasingly popular in the last few years, and although such schemes can appear low-risk, data from the Federal Reserve shows that one in four BNPL users made a late payment in 2024, up from 18% the year prior. [15]

Although BNPL schemes don’t typically have interest on them, they do come with penalties if you don’t pay on time, and you may be charged interest on a late fee, and these can add up and potentially hurt your credit score. The voluntary industry practice – such as reported by Klarna and Afterpay – is that penalty fees are capped at 25% of the original order value. [16]

The amount you can borrow on an BNPL varies per provider; for example, Affirm’s standard purchase limit is $30,000. [17] Looking specifically at the price increases, “debt numbness” was reached relatively later on compared to the other debt types. Starting at an average debt level of 2.5 (with a debt increase of $50), the stress values steadily increased until they reached 3.8/5 when an additional $10,000 was accumulated.

Methodology

A survey on behalf of JG Wentworth was conducted in July 2025 and asked 1,186 adults about their current debt situation and what psychological impacts their debt had on their mental well-being, and why. The questions then explored how respondents would feel if their debts increased, and how this varied by debt type, asking respondents to specify out of five how high their debt levels would be at different increments. The seven common types of debt covered in the study were:

- Credit card

- Student loan

- Medical

- Auto

- Mortgage

- Personal

- Buy Now, Pay Later

The demographics of the survey respondents were:

Gender:

- Female 52.8%

- Male 45.8%

- Non-binary 1.2%

- Prefer not to say 0.2%

Age:

- 18 – 26 42.6%

- 27 – 42 50.9%

- 43 – 58 5.8%

- 59 – 68 0.6%

- 69+ 0.1%

Level of Income:

- Less than $25,000 45.6%

- $25,000 – $49,999 44.9%

- $50,000 – $74,999 5.4%

- $75,000 – $99,999 2.2%

- $100,000 or more 1.9%

Sources

[1] Forbes, ‘More money increases happiness beyond $75,000’

[2] CBC, ‘Can money buy happiness? Income may boost emotional well-being more than we thought’

[3] KFF, ‘How Many Older Adults Live in Poverty?’.

[4] The Federal Reserve, ‘2024 Findings from the Diary of Consumer Payment Choice’

[5] Federal Reserve Bank of New York ‘Household Debt and Credit Report’

[6] CNBC,’ 3 reasons why your credit card interest rate is so high—that have nothing to do with you’

[7] Congress Gov. ‘A Snapshot of Federal Student Loan Debt’

[8] BestColleges, ‘Average U.S. Student Loan Debt: 2025 Statistics’

[9] KFF, ‘The Burden of Medical Debt in the United States’

[10] Statistica, ‘Share of used and new cars financed U.S. 2024’

[11] Ramsey Solutions, ‘Car Depreciation: How Much Is Your Car Worth?’

[12] Greater Texas Credit Union, ‘How Long Are Auto Loans? Understanding Car Loan Length’.

[13] Congress. Gov, ‘COVID-19: Household Debt During the Pandemic’

[14] The Motley Fool, ‘Average House Price by State in 2025’

[15] Benzinga, ‘America’s ‘Buy Now Pay Later’ Spend Set To Climb Nearly $117 Billion In 2025 As Fed Warns 1-In-4 Borrowers Miss Payments’

[16] Klarna, ‘Klarna launches customer-first late payments programme and financial support package for those who fall behind’

[17] Affirm, ‘How do I change my purchase limit?’

About us

With over 30 years’ worth of experience, JG Wentworth is an American financial services company that specializes in structured settlements, annuity purchases, debt relief solutions, and other offerings. JG Wentworth has helped resolve over 2.9 billion debts and 4 billion structured payouts.