On this page

What's next

Earn a high-yield savings rate with JG Wentworth Debt Relief

Shadow Debt: How much do people borrow from friends and family?

by

JG Wentworth

•

August 18, 2025

•

7 min

With research showing an alarming $1.18 trillion in credit card debt across the United States in the first quarter of 2025 [1], it’s no wonder that Americans are relying on other methods to help out during times of financial difficulty.

Whether you’re in need of cash fast, or facing longer periods of financial stress, sometimes tough decisions need to be made in order to stay afloat. But in times of need, personal loans or credit cards might not be the first instinct. Instead, turning to friends and family to borrow money might be a more attractive option.

To find out how many Americans have borrowed or lent money to friends and family, a survey on behalf of JG Wentworth asked 1,267 people to reveal how much they have borrowed or lent to those closest to them. The survey also asked respondents about how these loans have impacted their relationships moving forward, and how many are still facing the consequences of this decision.

Key findings:

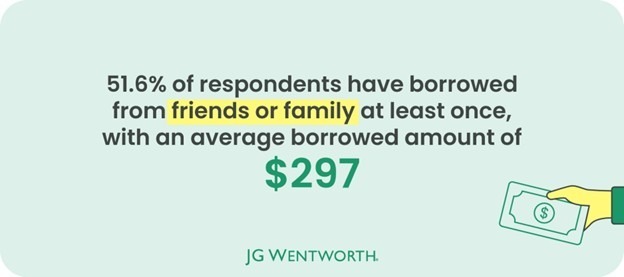

- 51.6% of respondents have borrowed money from a friend or family member at least once. Likewise, 53% said they have lent money to friends or family.

- When faced with a financial shortfall, nearly half of respondents (48.3%) said they would be most likely to ask a family member for money with no expectation of repayment.

- Parents (77.7%), siblings (75.8%) and grandparents (75.7%) are the family members respondents were most likely to turn to for financial support.

- The average amount borrowed from friends or family is $297, while the average amount currently owed is $237.

- If 51.6% of Americans borrowed an average of $297 from friends or family, this would equate to a total of approximately $52 billion borrowed nationwide.

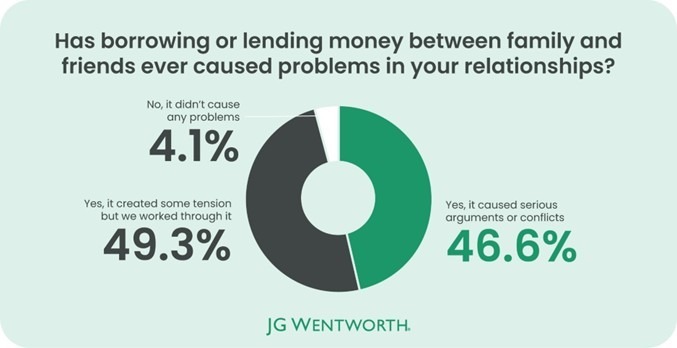

- 46.6% of those who have borrowed or lent money to friends and family said it caused “serious arguments or conflicts.”

- The negative impact of lending or borrowing to friends or family has caused 75.1% to say they’re no longer as close as they used to be.

- 48.1% of those who lent money reported that they considered taking legal action to recover a private debt, but ultimately decided against it.

Who would Americans turn to for financial support?

77.7% would turn to parents for financial support

When asked who they had actually borrowed money from, parents (77.7%), siblings (75.8%) and grandparents (75.7%) were the most common sources. Cousins followed closely at 75.5%, then aunts at 73.7%, and uncles at 73.4%.

Who do Americans borrow money from?

| Rank | Person | Percentage |

|---|---|---|

| 1 | Parents | 77.70% |

| 2 | Siblings | 75.80% |

| 3 | Grandparents | 75.70% |

| 4 | Cousin | 75.50% |

| 5 | Aunt | 73.70% |

| 6 | Uncle | 73.40% |

| 7 | Friend | 2.80% |

| 8 | Partner | 2.00% |

| 9 | Child | 0.20% |

*Only those who have borrowed money from friends and family. Respondents could select multiple answers.

On the other hand, respondents reported being less likely to have borrowed from friends (2.8%), partners (2.0%), or their own children (0.2%).

The survey also reveals that when faced with a financial shortfall, nearly half of respondents (48.3%) said they would first ask a family member for money with no expectation of paying it back. In stark contrast, only 1.1% would do the same with a friend.

Rather than borrowing money from those closest to them, 45.5% of respondents indicated they would prefer to take out a loan or use credit if they found themselves in need. Surprisingly, just 2.1% said they would borrow from friends or family with the intention of paying it back later.

The results highlight a strong reliance on close family members for financial support, particularly when repayment isn’t expected. On the other hand, it’s clear that Americans have a clear reluctance to involve friends in financial matters, especially without repayment plans in place.

How much do Americans owe to friends and family?

According to the survey, 51.6% of respondents said they had borrowed money from a friend or family member at least once, with an average borrowed amount of $297 in total.

Across the U.S., if 51.6% of the nation have borrowed an average of $297 from friends or family, this would equate to a total of approximately $52 billion borrowed across the country.

On the other hand, of those who said they had borrowed from friends and family, on average the participants currently owe $237. For the 47.4% who admitted they were yet to pay back this loan in full, this equates to approximately $38 billion.

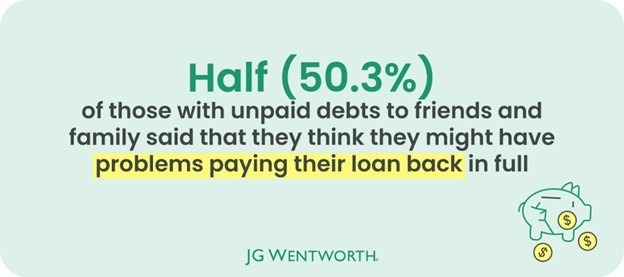

Half (50.3%) think they will have problems paying back their loans to friends and family

Nearly half of those with debts to family and friends (46.9%) said they had partially repaid the money they owe. More significantly, half of those with unpaid debts (50.3%) expressed concern that they may struggle to repay their loan in full, highlighting a considerable level of financial uncertainty among borrowers.

The survey found that 52.3% said they borrowed money with a clear repayment timeline in place. This agreement appeared more important to women who have borrowed money, with 53.8% reporting they had one in place, compared to 50.8% of men.

How loans have impacted relationships with friends and family

Even our closest personal relationships can become complicated when money is involved. When borrowing from friends or family, misunderstandings, delayed repayments or growing debts can often put strain on the relationship.

According to the people who have lent money personally to others, just over half (54.5%) said they’ve had to ask more than once to be repaid, leading to an understandably uncomfortable conversation to have between friends and family. In many cases (49.5%), the loan was given without a clear repayment timeline, leaving lenders unsure of when they’ll be paid back and often having to follow up multiple times to recover the full amount.

In addition to this, almost half of those who have lent money (49.9%) said they never put the loan in writing. Without this, it can be more difficult to solve disputes or prove that one person is in breach of the terms of the agreement. [2] This lack of formal agreement may explain why 50.4% admitted to losing money due to unpaid loans, whether partially or in full.

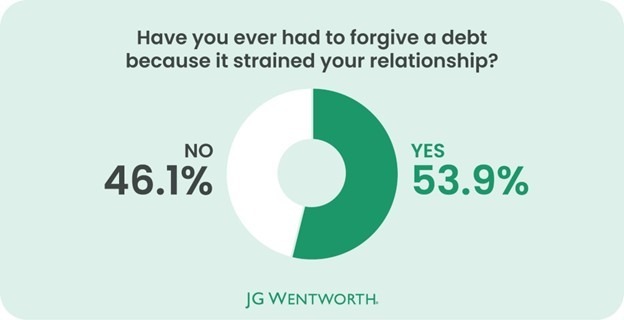

Over half (53.9%) have had to forgive a debt to save a relationship

When asked if they had ever forgiven a debt due to it putting strain on their relationship, 53.9% of those who have lent money said they had. The survey also suggests that women may be slightly more inclined to let debts go for the sake of preserving relationships, with 57.7% reporting they had done so, compared to 50.3% of men.

In addition to this, a staggering 46.6% said that borrowing or lending money to friends or family caused “serious arguments or conflicts.” Whereas for just 4.1%, it didn’t cause any problems.

It’s clear that lending money to friends and family can seriously affect relationships. A striking 75.1% of those who have borrowed or lent money said they are no longer as close as they used to be. This negative experience was echoed in the 71.3% who reported that the situation led to a temporary break in communication, or in extreme cases, caused such severe strain that the participants cut them off altogether (71.0%).

The impact of borrowing or lending money between family and friends

| Rank | Impact | Percentage |

|---|---|---|

| 1 | We are no longer as close as as we were before | 75.10% |

| 2 | We stopped speaking for a while | 71.30% |

| 3 | I cut them off or became estranged from them | 71.00% |

| 4 | It affected my own financial wellbeing | 69.90% |

| 5 | The relationship ended (e.g., friendship or partnership) | 69.10% |

*respondents could select multiple answers

Of those who have lent money, 48.1% reported considering legal action against their loved ones in an attempt to recover a private debt, but ultimately decided against it.

When asked if they had ever discussed interest being added to the repayment, 51.6% of those who have lent money said they had. On average, those who lent money to friends or family charged 3.21% interest.

Methodology

The survey was conducted on June 13th 2025 with 1,267 U.S. participants from diverse backgrounds. It explored their borrowing and lending habits with friends and family, including the amounts involved and any repayment issues. For some questions, respondents were able to select multiple answers, therefore the results do not all add up to 100%.

The demographics of the survey respondents were:

Gender:

- Female 49.5%

- Male 50.5%

Age:

- 18-28 45.6%

- 29-44 52.0%

- 45-60 2.2%

- 61-70 0.2%

Level of income:

- Less than $25,000 46.6%

- $25,000-$49,000 3%

- $50,000-$74,999 5.0%

- $75,000-$99,000 1.7%

- $100,000 or more 0.5%

U.S. population data accessed via Census.gov, accurate as of July 18th 2025.

Sources

[1] https://www.newyorkfed.org/microeconomics/hhdc

[2] https://www.nerdwallet.com/uk/loans/personal-loans/lending-money-to-friends-family/