On this page

What's next

Earn a high-yield savings rate with JG Wentworth Debt Relief

The Best States for Second Chances

by

JG Wentworth

•

February 2, 2026

•

10 min

In 2024, bankruptcy filings in the U.S. increased by 14.2% compared to the previous year. Breaking this down, business-related filings rose by 22.1%, while non-business filings grew by 13.9%. [1] This rising trend shows that more individuals and businesses are facing serious financial challenges each year.

To understand where people and companies have the best opportunity for a second chance after experiencing financial difficulty, we conducted a study to identify the top states in the U.S. for financial recovery. Our research examined a range of critical factors, including state unemployment benefits, consumer protection laws, credit repair regulations, and property exemptions. By combining these measures, we aimed to determine which states provide the most supportive environment for rebuilding finances and achieving stability after experiencing financial difficulties.

Key findings from the research:

- California is the best state for financial second chances, scoring highly for consumer protection laws, credit repair laws and exemption laws ($600,000 homestead).

- New Jersey is the worst state for second chances, with minimal exemptions amounts and a maximum weekly unemployment benefit amount of $132 – the lowest out of all states.

- Washington offers the best unemployment benefits available in the U.S. with a maximum of $844 weekly, or a minimum of $201.

- North Carolina offers the worst unemployment benefits with a maximum of $350 a week and minimum of $15.

- Nevada, Utah, and Louisiana rank highest for credit repair laws, offering a total of $100,000 surety bond protection, a five-day cancellation period to consider high-pressure purchases, and a 10-day refund period for faster reimbursements.

- The research found that Delaware has the highest average hourly attorney fees ($423), followed by New York ($398) and California ($391).

The best states for financial second chances

The study analyzed 16 metrics covering credit repair laws, exemption laws and consumer protection laws to determine the best and worst states for starting again after facing financial difficulties.

The top 20 states for second chances

| Rank | State | Average hourly attorney fees | Maximum weekly benefits amount | Homestead exemptions | Ranking out of 10 |

|---|---|---|---|---|---|

| 1 | California | $391 | $450 | $600,000 | 6.1 |

| 2 | Nevada | $330 | $483 | $605,000 | 5.7 |

| 3 | Kansas | $292 | $503 | $650,000 | 5.6 |

| 4 | Oklahoma | $257 | $461 | $650,000 | 5.2 |

| 5 | Texas | $345 | $521 | $650,000 | 4.9 |

| 6 | Iowa | $254 | $493 | $650,000 | 4.8 |

| 7 | Delaware | $423 | $400 | $125,000 | 4.7 |

| 8 | Maine | $236 | $462 | $80,000 | 4.7 |

| 9 | Massachusetts | $318 | $855 | $125,000 | 4.7 |

| 10 | Illinois | $349 | $505 | $15,000 | 4.6 |

| 11 | West Virginia | $195 | $424 | $35,000 | 4.6 |

| 12 | Minnesota | $305 | $491 | $450,000 | 4.5 |

| 13 | Nebraska | $256 | $456 | $60,000 | 4.5 |

| 14 | Utah | $291 | $617 | $43,300 | 4.4 |

| 15 | Louisiana | $266 | $221 | $35,000 | 4.4 |

| 16 | Washington | $322 | $844 | N/A | 4.2 |

| 17 | Connecticut | $384 | $667 | $75,000 | 4.2 |

| 18 | Ohio | $268 | $498 | $145,425 | 4.2 |

| 19 | Indiana | $278 | $390 | $19,300 | 4.1 |

| 20 | Virginia | $351 | $378 | $25,000 | 4.1 |

California is the best state for financial second chances

| State | Average hourly attorney fees | Maximum weekly benefits amount | Homestead exemptions | Household goods exemption | Jewelry exemption | Surety bond amount |

|---|---|---|---|---|---|---|

| California | $391 | $450 | $600,000 | $60,000 | $9,525 | $100,000 |

The research identified California as the best state for those seeking a financial second chance, earning an overall score of 6.1 out of a possible 10. California ranked highly in areas such as consumer protection laws, credit repair regulations, and exemption laws. [2] [3] [4]

Exemption laws protect certain assets from liquidation when facing bankruptcy. Homestead exemption is related to an amount of home equity and motor vehicle exemption also protects a certain amount of vehicle equity. [4] Wildcard exemptions offer protection of other assets and property such as tools needed for your profession or medical equipment. [5]

California stands out because of its strong safeguards for people rebuilding their finances after setbacks. In particular, the state’s homestead protections are among the most generous in the country, allowing individuals to retain significant equity in their primary residence.

Following California is Nevada, which scored 5.7 out of 10. Nevada performed well in areas such as jewelry and motor vehicle exemptions. The state offers $605,000 in homestead exemptions and $12,000 in household goods exemptions.

In addition, Nevada requires a $100,000 surety bond. A surety bond offers financial protection by ensuring credit repair businesses protect consumers from financial harm. [3]

In third place is Kansas, with a score of 5.6 out of 10. Kansas stands out for having the highest motor vehicle exemption at $20,000 and a maximum weekly unemployment benefit of $503, supporting residents who need financial protection while rebuilding after setbacks.

The worst states for financial second chances

| Rank | State | Average hourly attorney fees | Maximum weekly benefits amount | Homestead exemptions | Ranking out of 10 |

|---|---|---|---|---|---|

| 1 | New Jersey | $348 | $132 | $0 | 2.1 |

| 2 | Georgia | $340 | $365 | $21,500 | 2.2 |

| 3 | Alaska | $300 | $370 | $72,900 | 2.5 |

| 3 | Michigan | $294 | $362 | $40,475 | 2.5 |

| 5 | Kentucky | $236 | $569 | $5,000 | 2.6 |

| 6 | North Carolina | $295 | $350 | $35,000 | 2.7 |

| 7 | Vermont | $267 | $531 | $125,000 | 2.9 |

| 7 | Montana | $234 | $572 | $350,000 | 2.9 |

| 9 | New York | $398 | $504 | $179,950 | 3 |

| 10 | Florida | $335 | $275 | $650,000 | 3.1 |

The research identified New Jersey as the worst state for financial second chances, offering the most challenging conditions for rebuilding after financial hardship and scoring just 2.1 out of 10.

In New Jersey, the household goods exemption is only $1,000, and the maximum weekly unemployment benefit is $132, the lowest of any state. These limitations make it difficult for residents to retain assets or maintain financial stability while recovering from debt.

The best states for exemptions

| Rank | State | Homestead exemption | Household good exemption | Jewelry exemption | Motor vehicle exemption | Tools of the trade exemption | Wildcard exemption |

|---|---|---|---|---|---|---|---|

| 1 | Connecticut | $75,000 | 60,000 | 10000 | $3,500 | $35,000 | $1,000 |

| 2 | California | $600,000 | 60,000 | $9,525 | $3,625 | $9,700 | $0 |

| 3 | Kansas | $650,000 | 60,000 | $1,000 | $20,000 | $7,500 | $0 |

| 4 | Nevada | $605,000 | $12,000 | $5,000 | $15,000 | $10,000 | $10,000 |

| 4 | Oklahoma | $650,000 | 60,000 | $3,000 | $7,500 | $10,000 | $0 |

| 6 | Delaware | $125,000 | 60,000 | N/A | $15,000 | $15,000 | $25,000 |

| 7 | Maine | $80,000 | 60,000 | $4,000 | $10,000 | $9,500 | $500 |

| 8 | Hawaii | $20,000 | 60,000 | $1,000 | $2,575 | $35,000 | $0 |

| 9 | Arkansas | $800 | 60,000 | 10000 | $1,200 | $750 | $200 |

| 10 | Alabama | $16,450 | 60,000 | $0 | $0 | $35,000 | $8,225 |

Exemptions determine which of your possessions are legally protected from creditors if you encounter financial difficulty. They can include everything from your home and car to jewelry and tools, and the rules vary widely across the United States. Some states provide generous protection, while others leave very little safeguarded. [4]

At the top is Connecticut, which offers the strongest exemption laws. Residents can claim $75,000 for a homestead, $60,000 for household goods, $10,000 for jewelry (the highest in the country), $3,500 for motor vehicles, $35,000 for tools of the trade, and a $1,000 wildcard exemption for any other assets. This comprehensive coverage gives individuals significant protection across a wide range of property types.

The best states for unemployment benefits

| Rank | State | Maximum weekly unemployment benefits amount | Minimum weekly unemployment benefits amount | Maximum weeks you can claim |

|---|---|---|---|---|

| 1 | Washington | $844 | $201 | 26 |

| 2 | Massachusetts | $855 | $103 | 30 |

| 3 | Montana | $572 | $169 | 28 |

| 4 | Oregon | $673 | $157 | 26 |

| 5 | Ohio | $498 | $140 | 26 |

| 6 | Kansas | $503 | $125 | 26 |

| 7 | Arizona | $240 | $190 | 26 |

| 8 | New York | $504 | $108 | 26 |

| 9 | Pennsylvania | $583 | $68 | 26 |

| 10 | Rhode Island | $599 | $59 | 26 |

| 11 | New Mexico | $484 | $90 | 26 |

| 12 | Vermont | $531 | $74 | 26 |

Unemployment benefits provide temporary financial support to workers who lose their jobs through no fault of their own. These payments help cover essential living costs while individuals search for new employment. Each state sets its own rules regarding eligibility, weekly payment amounts, and the maximum duration for which benefits can be claimed. [7]

At the top is Washington, which offers the best unemployment benefits in the U.S. Residents can receive a maximum of $844 weekly and a minimum of $201 weekly, with benefits available for up to 26 weeks. One reason for these high amounts could be that in Seattle, the cost of living is about 45% higher than the national average, requiring more generous support to maintain financial stability. [8]

The states with the best credit repair laws

| Rank | State | Surety bond amount | Cancellation period (in days) | Refund period (in days) |

|---|---|---|---|---|

| 1 | Nevada | $100,000 | 5 | 10 |

| 2 | Utah | $100,000 | 5 | 10 |

| 3 | Louisiana | $100,000 | 5 | 10 |

| 4 | South Carolina | $25,000 | 10 | 10 |

| 5 | Illinois | $100,000 | 3 | 10 |

| 6 | Nebraska | $100,000 | 3 | 10 |

| 7 | California | $100,000 | 5 | 15 |

| 8 | Virginia | $50,000 | 3 | 10 |

| 9 | Oklahoma | $10,000 | 5 | 10 |

| 10 | Minnesota | $10,000 | 5 | 10 |

Credit repair laws are designed to protect consumers from unfair or deceptive practices when attempting to improve their credit profiles. These regulations clearly define what credit repair companies can and cannot do, ensure consumers have the right to accurate information in their credit files, and provide the ability to challenge errors directly with credit reporting agencies. [9]

The research identified Nevada, Utah, and Louisiana as the states with the strongest credit repair protections. In these states, companies are required to maintain a $100,000 surety bond and provide a five-day cancellation period, giving consumers time to cancel a credit repair contract without facing a penalty.

Additionally, these states have a 10-day refund period, meaning refunds are processed faster than in other states, improving cash flow for consumers and reducing financial stress during the credit repair process.

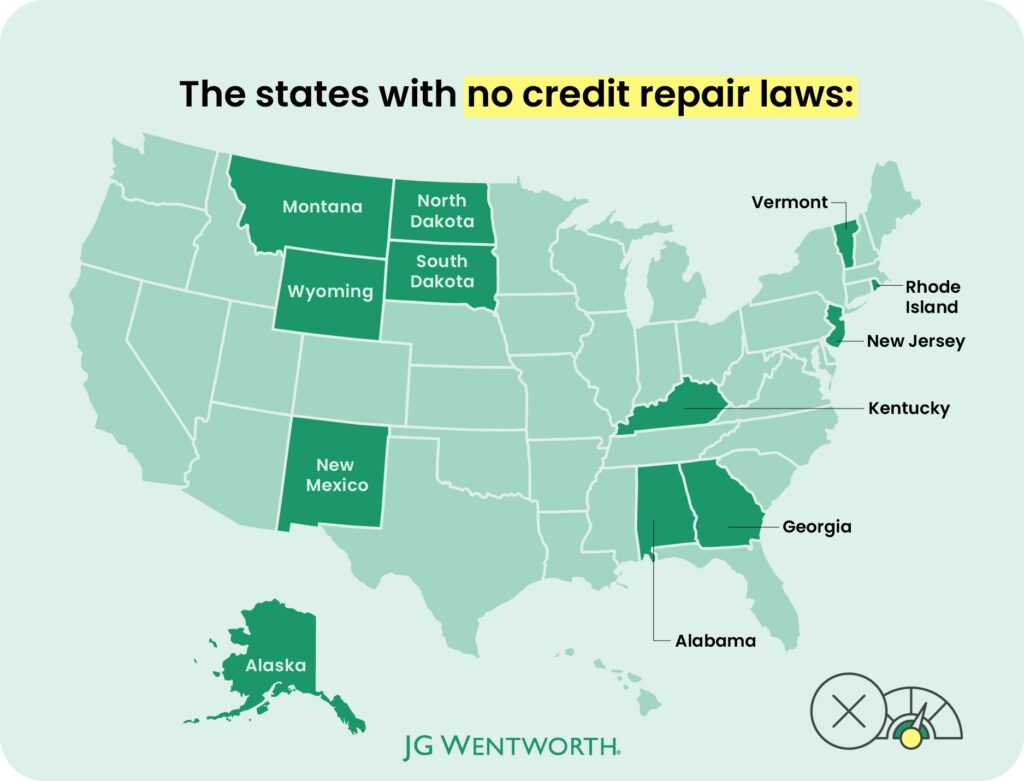

By contrast, New Jersey, Georgia, and Alaska among other states have no comparable laws in place. This lack of regulation leaves residents with fewer protections and limited options for holding credit repair companies accountable.

By contrast, New Jersey, Georgia, and Alaska among other states have no comparable laws in place. This lack of regulation leaves residents with fewer protections and limited options for holding credit repair companies accountable.

The states with the highest attorney fees

| Rank | State | Average hourly attorney fees |

|---|---|---|

| 1 | Delaware | $423 |

| 2 | New York | $398 |

| 3 | California | $391 |

| 4 | Connecticut | $384 |

| 5 | Virginia | $351 |

| 6 | Illinois | $349 |

| 7 | New Jersey | $348 |

| 8 | Texas | $345 |

| 9 | Maryland | $344 |

| 10 | Georgia | $340 |

When facing financial difficulties, hiring an attorney can be a crucial step. Bankruptcy lawyers can guide individuals through complex areas such as bankruptcy, debt collection, exemptions and benefits, ensuring that legal rights are fully protected. They also provide support in filing documents, representing clients in court and creditor meetings, and maximizing protections under both state and federal laws. [10]

The research found that Delaware has the highest average hourly attorney fees at $423, followed by New York at $398, and California at $391.

In contrast, West Virginia has the lowest average hourly attorney fees at $195, making legal services more accessible to residents with limited financial resources. Other states with low average hourly fees include Montana ($234), Maine ($236), and Kentucky ($236). These lower costs can help reduce the financial burden for individuals seeking legal assistance during times of economic hardship.

Methodology

Data was gathered from August to September 2025 from publicly available, reputable sources.

To determine the best and worst states for starting again after facing financial difficulties, we created an index ranking the following factors:

- Unemployment benefits

- Maximum weekly amount

- Minimum weekly amount

- Maximum weeks claimable

- Consumer protection laws

- Pre-suit notice requirement

- Class actions in state court

- Credit repair laws

- Registration requirement

- Surety bond amount

- Cancellation period in days

- Refund period in days

- Exemption laws

- Homestead exemptions

- Household goods exemptions

- Jewelry exemptions

- Motor vehicle exemptions

- Tools of the trade exemptions

- Wildcard exemptions

Each metric was normalized on a 1-10 scale, then combined according to its category weighting. For states that don’t currently offer exemptions or credit repair laws, they received a score of 0 for those metrics. For metrics with a simple “Yes” or “No” response, a “Yes” was scored 10 points and a “No” was scored 5 points.

Sources

[1] United States Courts, ‘Bankruptcy Filings Rise 14.2 Percent’, 2025

[2] Justia, ‘Consumer Protection Laws: 50-State Survey’, 2023

[3] Lexington Law, ‘Credit repair laws by state: What you should know’, 2024

[4] Justia, ‘Bankruptcy Exemption Laws: 50-State Survey’, 2022

[5] The Bankruptcy Site, ‘How to Use the Wildcard Exemption in Bankruptcy’, 2022

[6] Legal Information Institute, ‘15 U.S. Code § 1679e – Right to cancel contract’,

[7] USA.gov , ‘Unemployment benefits’, 2025

[8] Payscale, ‘Cost of Living in Seattle, Washington’,

[9] Bankrate, ‘The laws behind credit repair’, 2025

[10] Debtstoppers, ‘How can a bankruptcy lawyer help with your financial burden?’, 2024