On this page

What's next

Earn a high-yield savings rate with JG Wentworth Debt Relief

4 Shocking Facts About Gen X’s Finances

by

JG Wentworth

•

July 19, 2022

•

7 min

1. Gen X typically earns more per household than other generations

According to the Bureau of Labor Statistics’ 2020 Consumer Expenditure Survey, Gen X households’ mean gross income is $113,455—outranking Millennials ($84,975) and Boomers ($78,508). This difference feels stark, but it is likely because Gen X is at the peak of its working and earning years, plus more Gen X women work than their Boomer predecessors.

Naturally, because Gen Xers have more income, they spend an above-average amount in consumer categories. The typical Xer’s household spending comes to $75,087 annually, significantly higher than the national household average of $61,334. This could be because Gen Xers are caring both for their children and for their aging parents, giving them more significant financial responsibilities than other generations.

2. Gen Xers were hit hardest by the Great Recession, but they rebounded better

Gen Xers are no strangers to economic uncertainty, having experienced three recessions in their lifetimes—the dot-com bubble of the ‘90s, the 2008 financial crisis, and the ongoing pandemic.

The bulk of Gen Xers’ wealth was invested in their homes in 2007. However, while the Forgotten Generation suffered the biggest losses in home equity in 2008’s Great Recession, they also recovered better.

According to the Pew Research Center, this can be attributed to the fact that Gen Xers are currently experiencing their best earning (and saving) years—plus their home equity has doubled since 2010. However, because of the cynicism this generation formed around financial security, they are more risk-averse than their parents’ generation.

3. Gen X has the most debt

Despite their fantastic recovery from the 2008 financial crisis, more than half of Gen X has credit card debt—and an Experian report from 2019 found that they carry higher balances across credit accounts than any other generation.

Gen Xers own or are buying homes, care for their multigenerational families, and even still owe money on their student loans, in large part due to a jobs market that more commonly requires postsecondary education in applicants. Plus, some Xers are helping their kids pay off their own college debt!

According to Experian, ages 44 through 48 are typically “heavy debt years” regardless of generation, with 44-year-olds carrying a debt balance of $138,916 on average.

Still, Pew notes that Gen Xers’ debt is higher than their generational predecessors and that they have been unable to convert their extra income into wealth. That said, Gen X’s retirement prospects are very much at risk.

4. One in five Gen Xers says they’ll never be able to retire

Gen X is pessimistic about their ability to retire, with 20% saying they could never afford to retire, says AARP. The Transamerica Center for Retirement Studies (TCRS) found in 2019 that 41% of Gen Xers are worried about outliving their money, and according to a study conducted by Bank of America, only 23% of Gen Xers feel a sense of progress in their retirement savings.

Unfortunately, the evidence backs up their fears—TCRS found that the median retirement savings for an Xer comes to $64,000, which is less than half of Boomers’ $144,000 median.

Plus, because Social Security is dwindling and pension benefits are becoming less popular with employers, Gen X knows the onus of figuring out how to pay for retirement is entirely on them. In fact, 80% of Gen Xers plan to rely on 401(k)s or similar retirement funds to support themselves as they age.

Resolving Gen X’s credit card debt

For Americans stressing over their retirement prospects and struggling to pay off their debt, JG Wentworth offers a Debt Relief Program that could help you lower your debt and pay it off in as little as 24 to 48 months.*

If you’re concerned about how your debt could affect your financial goals, give us a call today at (888) 505-1794. Our team of Debt Specialists is here to negotiate with your creditors on your behalf and map out a personalized plan to pay off your debt faster, so you can get your future back on track.

Sources Cited

Kagan, J. (2022, June 23). Generation X (Gen X). Investopedia. Retrieved from https://www.investopedia.com/terms/g/generation-x-genx.asp

Hoffower, H., & Kiersz, A. (2021, November 5). Meet the typical Gen Xer, America’s ‘forgotten middle child’ who earns more than everyone else but has the most debt at $136,000. Business Insider. Retrieved from https://www.businessinsider.com/typical-gen-x-debt-net-worth-income-earnings-caregiving-stress-2021-8

U.S. Bureau of Labor Statistics. (2021, September 9). Consumer expenditure surveys tables (CEX). U.S. Bureau of Labor Statistics. Retrieved from https://www.bls.gov/cex/tables/calendar-year/mean-item-share-average-standard-error.htm

Fry, R. (2018, July 23). Gen X rebounds as the only generation to recover the wealth lost after the housing crash. Pew Research Center. Retrieved from https://www.pewresearch.org/fact-tank/2018/07/23/gen-x-rebounds-as-the-only-generation-to-recover-the-wealth-lost-after-the-housing-crash/

Stolba, S. L. (2019, April 17). Gen Xers have the highest average total debt balances. Experian. Retrieved from https://www.experian.com/blogs/ask-experian/gen-xers-have-the-highest-average-total-debt-balances/?sid=bi%7C611aec2b09e0357e41700375%7C1657038599385b7zfi3h5

Currier, E. (2018, January 26). How Generation X could change the American Dream. The Pew Charitable Trusts. Retrieved from https://www.pewtrusts.org/en/trend/archive/winter-2018/how-generation-x-could-change-the-american-dream

Next Avenue. (2021, January 4). Why Gen Xers are way more worried about money than Boomers. Forbes Magazine. Retrieved from https://www.forbes.com/sites/nextavenue/2021/01/04/why-gen-xers-are-way-more-worried-about-money-than-boomers/?sh=61377b3250b9

Impact Partners. (2018, February 9). Where did all the pensions go? Forbes. Retrieved from https://www.forbes.com/sites/impactpartners/2018/02/09/where-did-all-the-pensions-go/?sh=583127bf3aab

Khalfani-Cox, L. (n.d.). Financial facts about Generation X. AARP. Retrieved from https://www.aarp.org/money/credit-loans-debt/info-2015/gen-x-interesting-finance-facts.html

About the author

Recommended reading for you

*The debt settlement program is provided by JGW Debt Settlement, LLC. JGW Debt Settlement, LLC is licensed/registered to provide debt settlement services in states where licensing/registration is required.

Debt relief program results will vary by individual situation. As such, it may not be suitable for all persons. JG Wentworth does not offer debt relief services in all states and fees may vary from state to state. Not all debts are eligible for enrollment. Not all individuals who enroll complete our program for various reasons, including their ability to save sufficient funds. Savings resulting from successful negotiations may result in tax consequences, please consult with a tax professional regarding these consequences. The use of debt relief services can potentially have an adverse impact on your credit rating, may result in you being subject to collections, and may result in other adverse action by creditors or collection agencies. Read and understand the program contract prior to enrollment.

JG Wentworth does not pay or assume any debts or provide legal, financial or tax advice or credit repair services. You should consult with independent professionals for such advice or services.

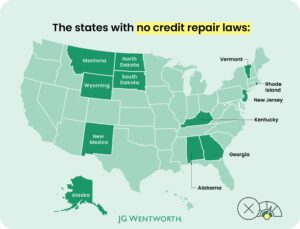

JGW Debt Settlement operates in the following states: AL, AK, AZ, AR, CA, CO, FL, ID, IN, IA, KY, LA, MD, MA, MI, MS, MO, MT, NE, NM, NY, NC, OK, PA, SD, TN, TX, UT, VA, DC, and WI. If a consumer in Georgia contacts us we may connect them with a law firm that provides debt resolution services in their state.